Table of Contents

🗝️ Key Facts

- Stolen admin credentials and weak MFA on Salesforce CRM opened the door.

- 1.4 million policyholders had names and social security numbers exposed.

- Millions of dollars lost to recovery, forensics and meeting regulatory compliance.

- The Allianz Life data leak underlines the importance of strong cloud identity governance across all sectors.

🎯 About the Target

Organisation Profile (Size, Sector, IT Landscape)

The Allianz Life data leak has become one of the most high-profile cyber incidents in the U.S. financial services sector. Allianz Life Insurance Company of North America is a subsidiary of global insurer Allianz SE, serving around 1.4 million U.S. customers with life insurance and annuity products.

While recognised internationally as part of one of the world’s largest insurers, its underlying reliance on third-party cloud platforms left it exposed to modern threats. This weakness became evident during the Allianz Life data leak, which revealed the risks of inconsistent security controls and dependence on external systems to safeguard sensitive customer data.

| Number of Staff | Approximately 2,000 (excluding contractors and agency staff) |

| Sector | Financial services (Life insurance and annuities) |

| Revenue | Part of Allianz SE, which reported €161.7 billion in total revenue for 2023 (Allianz Life’s U.S. revenue is not separately reported) |

| Services | Life insurance Annuities Retirement income products Risk advisory and financial protection services |

| Founded | 1896 (as North American Life and Casualty; acquired by Allianz in 1979) |

| Ownership | Subsidiary of Allianz SE (publicly listed on the Frankfurt Stock Exchange under ticker ALV) |

| Funding | Privately funded through revenue and capital markets, backed by the global Allianz SE group |

Pre‑attack security posture

- The organisation relied heavily on a Salesforce-based CRM platform to manage sensitive customer data, but controls were uneven and monitoring limited.

- Multi-factor authentication (MFA) was not enforced across all privileged accounts, leaving critical systems exposed.

- The IT estate was fragmented, with modern cloud platforms connected to older policy administration systems, creating inconsistent coverage.

- Patching and configuration management varied across internal systems and third-party environments, introducing exploitable gaps.

- Security governance focused on compliance rather than proactive defence, with limited threat hunting or red-teaming in place.

- Responsibility for data protection was shared between internal IT and external vendors, leading to blurred accountability.

- While certifications existed, there was no evidence of a mature cyber security leadership structure or strategy driving resilience.

🤔 Why They Were Targeted and By Whom?

Who Were the Attackers?

The Allianz Life data leak was the work of a financially motivated cybercriminal group that used social engineering and stolen credentials to breach Allianz’s Salesforce-based CRM system. Their aim was simple: steal sensitive customer information.

Unlike state-backed hackers or ransomware gangs, they were not interested in disruption. Weak authentication and gaps in third-party access opened the door, allowing them to quietly extract data.

Over 1.4 million U.S. policyholders had personal identifiers taken, including names and Social Security numbers. Suspicious activity was spotted in December 2024, the FBI was alerted, but the true scale only became clear in January 2025.

The incident highlights how criminals are increasingly bypassing traditional defences and going straight for cloud-hosted platforms that hold the most valuable data.

Strategic Appeal for Ransomware Groups

The Allianz Life data leak illustrates why organisations like this appeal to financially motivated cybercriminal groups. They look for companies that:

- Hold vast quantities of sensitive personal and financial data that can be monetised through fraud or resale

- Depend on third-party cloud platforms where access controls are often inconsistent

- Have complex IT estates that mix modern services with legacy systems, creating exploitable gaps

- Face regulatory and reputational pressure, making breaches highly damaging

For cybercriminal groups, the Allianz Life data leak represented the perfect environment: maximum data value, exploitable dependencies, and significant leverage once customer information was stolen.

Valuable data and weak defence

Allianz Life is believed to have been compromised through a weakness in its Salesforce-based CRM platform:

- Exposed third-party access without enforced multi-factor authentication (MFA)

- Specifically, administrative accounts on the cloud system that lacked consistent identity controls

This unprotected gateway:

- Allowed entry through social engineering and stolen credentials

- Enabled access to core customer records at scale

- Facilitated the exfiltration of sensitive personal data

In short, the Allianz Life data leak followed a familiar attack playbook, exploiting weak authentication on a high-value cloud platform.

Who Else Have They Targeted?

The Allianz Life data leak highlights why financial services and insurance providers are prime targets for cybercriminal groups seeking valuable personal and financial records.

Other victims of similar financially motivated actors include:

- Insurance: Prudential Financial (2023 breach affecting over 2.5 million customers)

- Finance: Experian (repeated data exposures involving millions of credit records)

- Healthcare: UnitedHealth Group’s Change Healthcare subsidiary (2024 ransomware/data theft incident)

- Government: U.S. Office of Personnel Management (2015 data theft of 21 million records)

- Cloud & IT services: Numerous SaaS and CRM providers exploited through compromised credentials

These incidents show how financially driven threat groups deliberately pursue sectors where data can be directly monetised, with insurance and financial platforms offering particularly rich targets.

⚡️What happened?

Understanding the Attack

The Allianz Life data leak was a large-scale theft of customer information. Attackers broke into the company’s Salesforce-based CRM and extracted data on more than 1.4 million U.S. policyholders, including names and Social Security numbers.

Unlike ransomware campaigns, no systems were locked and no ransom was demanded. The attackers’ sole focus was harvesting sensitive data for financial gain.

Suspicious activity was first detected in December 2024 and publicly confirmed in January 2025 after the FBI was notified. The impact has stretched far beyond initial containment, with Allianz Life now facing regulatory scrutiny, forensic investigations and the ongoing task of protecting affected customers.

What Type of Attack Was It?

This was a large-scale data theft attack, not ransomware. The attackers did not encrypt Allianz Life’s systems or demand payment. Instead, they gained covert access to the company’s Salesforce-based CRM platform and exfiltrated sensitive customer data, including names and Social Security numbers of more than 1.4 million U.S. policyholders. The Allianz Life data leak was financially motivated with stolen data likely intended for fraud or resale, rather than disruption or extortion.

How Did They Execute the Attack?

Allianz Life believes the attackers:

- Initial Access

- Compromised administrative credentials to Allianz’s Salesforce-based CRM platform

- Likely achieved through social engineering, phishing, or stolen credentials

- Exploiting Weak Controls

- Took advantage of inconsistent MFA enforcement on privileged accounts

- Maintained access by reusing valid logins without triggering alerts

- Privilege Escalation and Data Access

- Escalated permissions within the CRM environment

- Queried and extracted customer records including names and Social Security numbers

- Data Exfiltration

- Exfiltrated sensitive data covertly over normal Salesforce traffic

- Blended activity into legitimate platform use to evade monitoring

- Focus of the Operation

- Attackers concentrated on large-scale data theft only

- No ransomware deployed, no encryption of systems, and no ransom note left behind

Victims were not confronted with ransom notes or system outages; instead, their sensitive data was quietly removed from Allianz Life’s environment, later disclosed once forensic analysis confirmed the scale of the Allianz Life data leak.

🔄 Attack Mechanism

MITRE Mapping

| Tactic | Technique | MITRE ID | Context in Allianz Life Data Leak |

| Initial Access | Valid Accounts (compromised credentials) | T1078 | Attackers gained entry using stolen or socially engineered admin credentials for Salesforce CRM |

| Initial Access | Phishing / Social Engineering | T1566 | Likely use of phishing or spear-phishing to harvest login details and bypass access controls |

| Exploitation | Exploitation of MFA Gaps | T1556 | Inconsistent enforcement of multi-factor authentication allowed persistence with stolen credentials |

| Privilege Escalation | Abuse of Cloud Application Permissions | T1068 / T1078.004 | Elevated privileges within the Salesforce environment to expand access |

| Discovery | Account & System Enumeration | T1087.002, T1016 | Queried and mapped CRM records to locate high-value customer data |

| Collection | Credential dumping | T1213 | Extracted names, SSNs, and policyholder data from Salesforce CRM |

| Exfiltration | Account & System Enumeration | T1041 | Stolen data exfiltrated over normal Salesforce traffic, blending into legitimate flows |

| Impact | Exfiltration over FTP or web (e.g. FileZilla, Rclone) | N/A | No encryption, no ransom demand, attackers focused solely on large-scale data exfiltration |

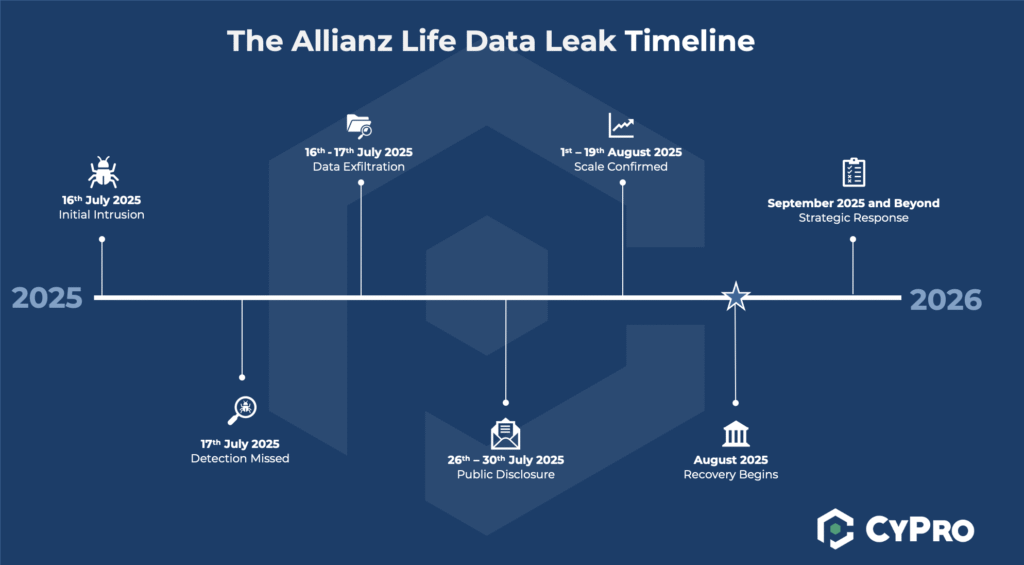

🕰️ Timeline of the Allianz Life Data Leak

This timeline illustrates the key events and milestones in chronological order. It provides a clear view of how the situation unfolded, helping to contextualise the decisions, responses, and impacts over time.

Initial Intrusion: 16 July 2025

At 22:00 on Wednesday 16 July, the Allianz Life data leak began when attackers gained access to a third-party, cloud-based Salesforce CRM system. The entry point was compromised administrative credentials obtained via social engineering.

Within minutes, the attackers began pulling sensitive customer records by:

- Using stolen credentials

- Querying CRM datasets at scale

- Mimicking normal user activity to avoid alerts

These were the earliest signs of hostile access that would later escalate into the Allianz Life data leak.

Detection Missed: 17 July 2025

Just after midnight on Thursday 17 July, Allianz Life’s monitoring flagged unusual CRM queries. Security teams intervened by:

- Blocking suspicious sessions

- Reviewing logs

- Escalating to internal investigators

By the morning, the FBI had been notified. However, forensic analysis showed exfiltration had already begun, meaning the Allianz Life data leak was in motion.

Data Exfiltration: 16–17 July 2025

By dawn on Thursday 17 July, forensic evidence showed attackers had extracted data including names and Social Security numbers of over 1.4 million policyholders. Exfiltration was carried out by:

- Leveraging valid credentials to disguise malicious queries

- Blending data transfers into normal Salesforce traffic

- Avoiding detection tools by staying within authorised access patterns

This marked the point where the Allianz Life data leak escalated into a major compromise.

Public Disclosure: 26–30 July 2025

With the breach confirmed, Allianz Life escalated its response:

- 26 July: Filed breach notification with the Maine Attorney General

- 30 July: Allianz Life publicly confirmed the Allianz Life data leak, disclosing exposure of sensitive customer information.

- Began preparing customer support measures, including credit monitoring

At this point, the Allianz Life data leak became widely known, triggering regulatory involvement and press coverage.

Scale Confirmed: 1–19 August 2025

As investigations progressed, the true scale of the breach emerged:

- 1 August: Allianz Life began customer notifications and identity protection offers

- 19 August: Have I Been Pwned listed the Allianz Life data leak, confirming approx. 1.1 million impacted

Reuters and other outlets reported that the attack was financially motivated and exploited weak authentication controls on Salesforce.

Recovery Begins: August 2025

Allianz Life allocated emergency resources to stabilise and contain the incident. Immediate steps included:

- Securing the Salesforce environment

- Enforcing stronger MFA and identity controls

- Providing two years of credit monitoring to affected individuals

This phase marked the start of a longer recovery process following the Allianz Life data leak.

Strategic Response: September 2025 and Beyond

By September 2025, Allianz Life announced a strategic overhaul of its cyber security posture, including:

- Cloud security modernisation

- Stricter vendor access governance

- Continuous monitoring of critical systems

- Elevating cyber security to an executive-level board priority

The Allianz Life data leak demonstrated that even modern, cloud-based platforms can become single points of failure. Full recovery, trust rebuilding, and operational reform are expected to extend well into 2026.

The Allianz Life data leak highlights how cloud platforms can become single points of failure when security is inconsistent. Strong identity controls and vendor governance are essential to protect sensitive customer data.

💥 Impact of the Cyber Attack

The attackers deployed no encryption and made no ransom demand; their objective was purely the large-scale exfiltration of data from Allianz’s Salesforce CRM environment. The Allianz Life data leak exposed over 1.1 million customers to fraud and regulatory fallout.

| Types of Impact | Known Impact |

| Operational effects | Access to Salesforce CRM compromised, exposing sensitive policyholder records; while no outage occurred, investigation and remediation created internal strain |

| Financial consequences | Millions expected in recovery, forensic costs, and regulatory compliance |

| Reputational | Public disclosure in Jan 2025; communication needed to reassure 1.4m customers |

| Human / People Impacts | Personal identifiers, including SSNs, leaked; heightened risk of fraud |

| Ongoing Impacts | Credit monitoring and regulatory scrutiny ongoing |

| Supply Chain Disruption | ╳ |

| Regulatory / Legal Action | U.S. regulatory investigations initiated; possible new compliance mandates |

| Intellectual Property Loss | ╳ |

Operational effects

- Salesforce CRM breach exposed core customer records, showing how one cloud gap can lead to mass compromise

- Incident response drained resources, slowing operations and delaying customer services

- Reliance on a third-party platform proved as fragile as outdated legacy systems

Financial consequences

- The Allianz Life data leak is expected to cost millions in forensics, legal support, compliance, and customer protections

- Emergency spending on external responders and credit monitoring highlighted the cost of being unprepared

- Long-term investment is now required to modernise identity controls and strengthen cloud security

Reputational

- Allianz Life confirmed the data leak in January 2025, choosing transparency to contain damage

- Clear communication and FBI cooperation helped preserve trust, though resilience was called into question

- The Allianz Life data leak triggered a sector-wide debate on the safety of financial services data in the cloud

Human / People Impacts

- The Allianz Life data leak exposed personal data of 1.4 million policyholders, including Social Security numbers

- Customers face years of identity theft risk and heightened financial anxiety

- Staff were placed under intense pressure to balance customer support with regulatory demands

Ongoing Impacts

- Months after disclosure, the Allianz Life data leak was still under forensic review and regulatory investigation

- Allianz began a major security overhaul, making cyber risk a boardroom priority

- The incident has made resilience and compliance non-negotiable for future operations

Regulatory / Legal Action

- The Allianz Life data leak drew scrutiny from state Attorneys General and federal agencies

- Regulators are pushing for tougher mandates on cloud-hosted financial data

- The leak is now treated as a consumer protection and trust issue, not just a corporate failure

💬 Professional Commentary

“On July 16, 2025, a malicious threat actor gained access to a third-party, cloud-based CRM system used by Allianz Life. We took immediate action to contain and mitigate the issue and notified the FBI.” — Allianz Life spokesperson, AP News

This was not a minor breach.

It was the Allianz Life data leak, a large-scale exfiltration of sensitive customer data from a global insurer.

Over 1.1 million individuals were affected.

Social Security numbers and personal identifiers were stolen.

Regulators and law enforcement were drawn in.

The scale of the Allianz Life data leak, potential for fraud, and reputational consequences places this incident in a different league.

It exposed weaknesses in access controls and raised urgent questions about cloud security oversight in the financial sector.

“MFA is vital, but not foolproof, attackers can bypass it with social engineering. A Zero Trust approach is needed to better protect identity systems.” – Tarun Desikan, EVP at SonicWall, ITPro

Weak or inconsistent identity controls remain the Achilles’ heel of even well-resourced organisations.

The Allianz Life data leak demonstrated that while cloud systems may be technically advanced, but when authentication gaps exist, they create exploitable cracks.

This was not only a technical incident but also a governance issue.

When third-party platforms hold critical data, accountability for securing them must be explicit and enforced, a lesson underscored by the Allianz Life data leak.

“The incident stemmed from social engineering and credential misuse targeting administrative access.” – Allianz Life breach notification, July 2025, Maine Attorney General filing

The lack of consistent MFA enforcement was a known weakness.

Had stronger authentication and vendor access controls been in place, the scale of the Allianz Life data leak could have been contained.

Identifying risks is not enough.

In organisations managing millions of sensitive records, remediation must be timely, comprehensive, and mandatory, as the Allianz Life data leak made clear.

⚖️ Comparative examples (Equifax, Prudential Financial)

Flat identity controls, reliance on third-party platforms, and weak authentication are recurring themes in some of the most damaging cyber incidents. When access to high-value systems is not properly secured, a single compromise can lead to the mass exposure of personal data, regardless of the size or maturity of the organisation.

The Allianz Life data leak is not an isolated case. Similar weaknesses were evident in the following high-profile incidents:

- Farmers Insurance – Third-party vendor breach, mid-2025

In May 2025, Farmers Insurance suffered a data breach via a third-party vendor that compromised records of over 1 million individuals, including names, dates of birth, driver’s licence numbers, and partial Social Security numbers. The insurer provided identity theft protection to those affected and was required to notify multiple states’ regulators about the incident. - Bank Sepah (Iran) – State-backed institution hit by destructive cyberattack, June 2025

On 17 June, Reuters reported a cyberattack claimed by the group Predatory Sparrow, suspected to have Israeli ties, which disrupted services at Iran’s Bank Sepah, including ATMs and online banking. While attribution remains murky, the attack exemplifies how weak access controls can be exploited in critical national institutions.

These cases underscore how platforms and systems, whether cloud-hosted or state-level, can become single points of failure when not properly secured. The Allianz Life data leak follows the same pattern: compromised authentication and third-party access controls enabling large-scale data exposure.

📚 What Can be Learnt?

Crucial Angles Often Overlooked

- Make Cyber Resilience a Priority – For financial institutions like Allianz Life, breaches are inevitable. Investment must focus not only on preventing attacks but on rapid detection, containment, and recovery to reduce long-term impact.

- Test and Refine Your Response Under Realistic Conditions – An incident of this scale showed how quickly trust can be shaken. Regular crisis simulations and red-teaming ensure staff and executives can act decisively when sensitive customer data is compromised.

- Act on Known Risks Before They’re Exploited – Inconsistent MFA enforcement on privileged accounts was a known weakness. Addressing authentication gaps and third-party access risks earlier could have reduced the scale and severity of the Allianz Life data leak.

📋 Your Action Plan

- Mandate MFA across all privileged and administrative accounts in cloud platforms to shut down the most common attack route.

- Tighten vendor governance with strict access controls, continuous monitoring, and contractual security obligations to limit third-party risk.

- Reduce privilege creep by regularly reviewing and removing excessive access rights in Salesforce and other high-value systems.

- Implement proactive monitoring of cloud environments to detect abnormal data access patterns before they escalate.

- Equip staff with targeted training on phishing and social engineering to lower the risk of stolen credentials.

- Test your defences through regular red-team exercises and crisis simulations to build confidence under real-world conditions.

Final Thoughts

The Allianz Life data leak proves that a single weakness in authentication, vendor access or cloud security can expose millions. For financial institutions, it is a warning that resilience must replace complacency.

If you are unsure how your organisation would cope with a real attack, that uncertainty is already a risk. CyPro helps uncover blind spots, strengthen defences and prepare leadership for crisis. Contact CyPro today to assess your vulnerabilities, build resilience and take control of your cyber security posture before you face a crisis like the Allianz Life data leak.